In 2010 when Heppelmann stepped up to PTC’s executive top chair, the first thing he did was not about the technology as one might think. It was about things in the business area:

”Yes, we had to improve profitability because 13 years ago PTC was not very profitable, something that the shareholders were not very happy with. So, we did a lot of restructuring to sharpen the company’s structure and improve profitability. Since then, we have continued to raise profit levels dramatically over time. From a company that was at low double-digit profit levels to one that is approaching 40 percent,” says the former PTC executive.

The technological modernization and Creo’s great importance

But, of course, technology development also received its fair share of the then new CEO’s attention. The PLM suite Windchill was already modern, as the company under Heppelmann had rewritten the entire code in Java–at a time when no PLM products were written in this language, today everything is–and adapted the solution to the requirements of the time and the future. However, there were other challenges; the parametric CAD classic Pro/ENGINEER had started to feel a bit old-fashioned.

“Yes, we were already solid with Windchill, but we were also looking for a product that could really increase growth. It turned out to be Creo. Thirteen years prior Pro/ENGINEER (ProE) had fallen back after multiple parametric competitors arrived in the market. It was still a powerful product, but the user interface was outdated and people thought ”this is old, a dinosaur ”, says Heppelmann.

2011 was the time for the launch of the new Creo. The event at Park Plaza Castle, in Boston, is probably among the most memorable in the industry in the 21st century. Creo was an ”all-in-one CAD suite” and the presentation and functionality of the product became an experience that went beyond most. The ProE business had tended to stagnate in the years before. The success with the parametric technology prior to the turn of the millennium, when PTC owned the CAD market, had resulted in a somewhat tired organization. Creo’s debut definitely shook it up. The employees at PTC were jubilantly happy and there was no chance to miss the fervor of what Jim Heppelmann called a ”CAD revolution”.

The entire structure of the solution had been reconfigured and, among other things, role-based apps were introduced. The launch event also became a visually dramaturgical highlight of great proportions with prison cells and other illustrations, based on the assumption that designers were symbolically locked in the prison cell of the old CAD world.

”Now is the time to break free, release your locked-in creativity and open the imaginary cell door to a new freedom in the CAD-world,” Heppelmann said from the stage.

The solution was a success and is currently still a key piece of software that drives PTC’s revenue streams:

“Yes, Creo is the biggest, but Windchill PLM is not far behind. Creo’s revenue is around $800 million out of a total of just over $2 billion, corresponding to approximately 40 percent,” says Heppelmann.

Best-in-Class – ”PTC did with Creo what Dassault still haven’t managed”

But any change to old worn-out patterns in the design work requires a certain amount of caution in order to be successful. CAD is no exception. Partly it is about openness, manifested through availability of previously made design data, models and deep integration, partly about establishing new methodologies that come with the new.

“In general, all of PTC’s products are well integrated and best in class in terms of openness,” claims Heppelmann, adding that the latter also applies to Siemens, ”while some of our competitors’ strategies are not customer-friendly and not open in the same way.”

The latter is of course about Dassault Systemes (DS) and the difficulties over time to establish its latest V6 version on the market instead of the currently dominant V5 platform.

“Yes, we see clear differences here. Creo and Dassault’s V6 version of CATIA came out within the same timeframe, around 2010-2011. Already by 2014, the adoption of Creo was largely completed in the customer chain. This while DS V6 is hardly adopted even today, 13-14 years later. This reminds us of the value of being cautious on the way forward for customers. I know that the SOLIDWORKS users for example are not very happy with how the journey is developing where they are now more or less forced to 3DEXPERIENCE. And it’s not really even an upgrade, basically just the same solution but on a different platform that is incompatible with the previous one.”

A tough leadership style

Leading an organization in parallel technical and business change processes places very high demands on the leadership role. The pieces carried out above touch in this part of the whole. Before we continue with the technological milestones during Jim Heppelmann’s time at the helm, let’s briefly look at the importance of the leadership role for PTC’s path.

Once the basic pieces were in place, the continuation was largely about vision. About the ability to formulate angles of attack on ideas, opportunities and challenges in ways that were easy to understand, at the same time exciting, and where you didn’t lose momentum anywhere. Not least this applies to an organization like PTCs, where the innovative culture sits in the walls. How do you make this work? Jim Heppelmann:

“I agree with the great importance of the vision. My leadership style was to outline a strong vision of what was possible, show with passion that PTC was the company that could make it possible, and then lead from the front lines with hard work and a hands-on approach. I have never been afraid to dive into the technical or business details. The feedback I’ve received is that my communication style is to be honest and direct, and I have a skill for making complex topics easy for everyone to follow, whether it’s at a LiveWorks keynote or in everyday meetings.”

In addition to this, an impression is that there are high demands on both employee deliveries and technical skills. Not least the latter has characterized Heppelman’s years as top executive. It is of course also of great importance when developing new technologies that will last for the future. Heppelmann describes himself as more of a ”technical guy” than his successor, Neil Barua. How will his leadership style differ from yours?

“Neil is of course a different person than me. We have characteristics that are common and then we all have something that is unique. Neil is a great leader for the times and given where PTC is now. He has what PTC needs from its leader. He is a little less technical than me, but very great with customers, employees and financial acumen.”

The technological milestones and key acquisitions

The visionary and passionate leadership that Heppelmann talks about has undoubtedly been an asset on the technological journey since 2010. Let’s take a look at some milestones that have been a prerequisite for the strong position the company has today.

Of course, the sharpened PLM and CAD solutions were of basic importance, but perhaps even more important questions have been about how the future would develop alongside this.

Around 2010, the IoT trend was on the horizon and Heppelmann and his colleagues thought about how to create related concepts for the PLM and automation areas. But they still wanted to go further: How could digital twins, sensors and connected AR technology not only improve and support product development work, but also important future trends such as Product-as-a-Service? Can we create a suite of seamlessly connected software that can also feed back into the PLM system and where the use of the products by the end customers could be reflected in the innovation work? This while being able to meet the development where electronics and integrated software step by step trump the importance of mechanics?

The questions were several, but PTC started by looking at IoT.

“We did that,” says Heppelmann. “As the profitability of the company improved significantly, our board said to me, ‘Jim, how can you make us grow even faster?’ I had several ideas here, one of which was IoT, which looked like a promising technology. You have heard me say that IoT is PLM, what do I mean by this? The ”T”, which stands for ”things”, is about manufactured products and the reason you connect manufactured products to the Internet is to better manage them throughout their lifecycle. The answer was that we bought ThingWorx for IoT, Axeda for deployment of enterprise-grade applications for connected products and then Kepware to connect to various shopfloor devices like PLC, OPC, RTU, Database, as well as sensors and actuators.”

But the development thoughts did not stop there; PTC saw how the software side of manufactured products took up more and more space in the design work and everything pointed to this continuing to increase exponentially.

“Exactly, and during the same time frame we also made our first ALM (Application Lifecycle Management) acquisition, which was the company MKS, with the Integrity product line. Later, we bought Codebeamer, which is a state-of-the-art ALM system,” comments Heppelmann.

Augmented Reality – an unbeatable visual aid

Undeniably, the now-retired PTC CEO has operated during an era of major technological change and the ALM ventures are one face of the facets here following the powerful advance of the IoT trend, but there are other areas too:

“Yes, after the IoT investments, we moved forward in augmented reality (AR) with the purchase of Vuforia. This is still a very exciting technology where there is much to learn, both in terms of visualization support for product development and AR as a guide tool in maintenance work where you can see, for example, exactly how a spare part should be replaced. There is a lot for companies to do here.”

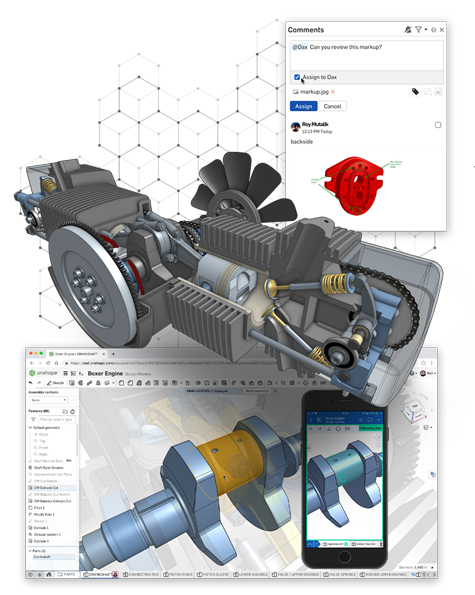

“So overall, during this time we went from updating Windchill’s PLM code and rebuilding the CAD system to adding ALM, IoT, AR and then, more recently, adding SaaS (Software-as-a-Service). In the latter case, not least the purchases of Onshape – with CAD, PDM, simulation and other things available in the cloud via your usual browser without the need to download the software – and Arena PLM play important roles.”

How do Onshape and Arena fit into the PTC puzzle?

Two PLM packages

The overview of PTC as a PLM developer is that today they have two main packages, a more high-end oriented one, Windchill PLM and the Creo CAD package, and a mainstream package, with Onshape’s cloud CAD and PDM directly in the browser, plus Arena PLM. How have these packages evolved? Heppelmann:

“I really think it is appropriate to have product lines with support from mainstream to advanced products. In CAD, for example, this is something like Dassault Systemes with CATIA and SOLIDWORKS and in the case of Siemens, the equivalent is about NX and Solid Edge. This is a well-established pattern in the industry and it provides the flexibility needed to position things differently and focus on different activities.”

On the high-end side, Heppelmann says that they have focused on the digital thread concept and, for example, product platform strategies with modular products that can be configured in many different ways.

“Yes, with Windchill PLM, Creo and Codebeamer we have great ways to cover these aspects. On the other hand, we have positioned Onshape and Arena for Agile product development, especially aimed at startups, new companies or new divisions of existing companies, i.e. players who want to run product development like speedboats instead of ocean-going ships. Fast and flexible,” he said explaining that, “In general, the entire software development industry has moved to Agile as a development methodology, but on the hardware side, they haven’t. Almost no companies develop cars, airplanes or construction equipment using Agile techniques. They use waterfall or stage-gate techniques. So, we’re going to focus Onshape and Arena on the cutting-edge new product development method called ”Agile” and enable companies to simultaneously use Agile on both the hardware and software sides of their product development processes.

The breakthrough

of the SaaS model

The purchase of Onshape, SOLIDWORKS founder Jon Hirschtick’s latest creation was a purchase that surprised the market. But Heppelmann firmly believed in cloud CAD and the SaaS model that was typical of Onshape. Moreover, it was also a logical consequence of PTC’s entire offering moving from the perpetual licensing model to the SaaS concept’s rental and subscription model.

His stance on the subscription model resulted in some criticism, not least due to the fact that PTC now had to spread the income over an entire subscription period, for example 3 years, instead of including the entire amount already at the time of sale, as before. The delay in revenue flow with the SaaS model also created an initial dip in revenue before the aggregate effect caught up and also over time overtook the old “perpetual” model.

In the end, reality proved Heppelmann right after the introduction of the model:

“Very much so,” he says. “This business model transition worked great and we definitely proved it was worth doing. The change pushed revenue into the future, yes, but then the future comes in and now we are in the future and PTC has the highest growth rate in the industry right now. By the way something that we have now had for several years. The company is now in its eighth year of double-digit growth. Creo and Windchill are each in their 7th separate year of double-digit growth. A lot of it is related to the business model transformation you’re talking about.”

Record high market value – but Dassault grew faster

Undeniably strong growth figures and PTC’s market value have grown to record high levels during Heppelmann’s leadership.

“Yes, when I became the CEO, the total market CAP was about $2 billion, and last week it was $22 billion! Eleven times higher. PTC has really been a very good investment,” sums up the former PTC boss.

This is, of course, an extremely good value development. But as true as the growth Heppelman has generated for the company is there’s a revenue trend between PTC and Dassault Systemes over the same period that shows a significant difference to PTC’s disadvantage. PTC’s revenue from 2010 to now doubled from $1 billion to plus $2 billion, while competitor Dassault Systemes during the same period tripled its revenue from about $2 billion to $6 billion. How can this be explained?

“There are a couple of different aspects to this,” Heppelman replied. “First, Dassault is a good company and the fact that we are comparable to them is honorable as a measure of our development. But the background is highly relevant: I became CEO of a company that wasn’t doing so well. I had to fix many problems and it took time. In this perspective, Dassault was strong right from the start, while I had to make PTC financially and technologically strong and that took maybe five years. Today, however, we are very strong.

“The other aspect is that during this period Dassault made many large acquisitions, much larger than the ones we made. DS’s $7 billion purchase of MEDIdata, for example, meant they bought a very large company with large revenues. There’s only one acquisition we’ve ever made that was over a billion dollars, ServiceMax at $1.5 billion. We have acquired several great companies, but they have been comparatively small, but with great technology. They just didn’t come through the door that big, but we’ve expanded their operations all the more.”

As a third factor in this, Jim Heppelmann points to the value development we talked about in the article intro above: “PTC’s share value has grown more than Dassault Systemes’. So, based on the measure of the stock price, PTC has done better during the time frame I have been CEO. In the end the share price is what the CEO is held accountable for because the investors who own the company want this kind of performance.”

Heppelmann’s best buy

Finally: Which of the company’s purchases does Jim Heppelmann consider his best?

“A difficult question because there are many good ones, but I think time will show Codebeamer to be the best. Why? Because PTC has now become very strong again in the automotive industry. Historically, we have been known as a sharp tool for powertrain CAD, but today the future of powertrains themselves is unclear. With Codebeamer, we become known as the software development tool for managing the ALM development process. It is a strategic highlight, enabling us to gain strong positions within leading OEMs and suppliers. In addition, it will eventually expand beyond the automotive industry and into virtually every industry. With that, the future of Codebeamer is extremely promising.”

Much suggests that he is right in his assessment of the future. Electronics and software are, according to all observers, growing exponentially in importance and the software portfolio Jim Heppelmann is handing over to Neil Barua, looks strong. Furthermore, the technological growth in the breadth of connected capabilities makes PTC a tough challenger to above all Dassault and Siemens among the high-end PLM companies. Particularly strong parts are about Windchill as the PLM backbone, CAD, the IoT pieces and not least the SLM solutions – Servigistics and the recently purchased ServiceMax – which connect key areas such as service and spare parts management to PLM. On the simulation side, they have teamed up with Ansys, who, as Heppelmann points out, are world leaders in the entire CAE area.

Besides that a success factor for a continued strong PTC will be about how they match the development in the AI area, and here the former PTC chief is convinced of the company’s extraordinary possibilities:

“AI will affect the entire software industry dramatically over time,” he says. “It is mainly because of the concept of a copilot; an assistant that highlights the concept that the software doesn’t just take supportive direction in your work, but actually offers suggestions based on its own capabilities. We started working on this too early; for example in Creo with generative design and today’s solutions, our generative design suggests to Creo designers effective solutions to the problem they want to solve. If you see generative design as the first step, I think there will be many more and it will not only be in Creo, it will happen and is already happening in Vuforia, and it will happen in Windchill PLM as well.

This development will not take place overnight,” says Heppelmann, “It will happen everywhere over time and PTC will play a leading role.”

It’s dinner time for PTC, and Neil Barua’s table is set for action, claims the former PTC chief.