First of all, CIMdata’s commenting document on SAP PLM as a mid-market player is fairly general. The perspectives are more general and reason around what the PLM needs among mid-market companies looks like. Among other things, it is written that PLM promises a lot for mid-market companies because these technologies are, ”helping [companies to] streamline their product development processes. Despite the potential benefits, these companies often encounter myriad challenges in adopting and effectively using PLM-enabling software. These challenges include high costs, complexity, lack of user-friendliness, and integration issues, coupled with a deficiency in awareness and expertise. Mid-market companies require an affordable PLM solution that can deliver tangible benefits in a short timeframe, enabling them to keep pace with larger competitors and evolving market demands.”

Many midmarket companies work too limited with PLM

There is not much to object to this analysis. PLM is needed and can do a lot to meet the challenges. But the analyst also points out obstacles on the journey towards PLM:

“High cost is a primary concern, as these companies often operate on tight budgets and cannot afford the substantial investment required for PLM software, customization, and ongoing support. Complexity is another major hurdle; PLM software can be overly intricate, making it difficult for smaller teams to manage it effectively.”

It is further noted that many mid-sized PLM users limit their use of product data management (PDM) functions to such as document, CAD, BOM and change management. What is meant is a narrow use of PLM, which ”indicates a gap between the potential of PLM enabling solutions and their actual utilization in mid-market companies.”

So, where does SAP cloud PLM fit into this? Is the ERP giant really the right solution to take care of the matter?

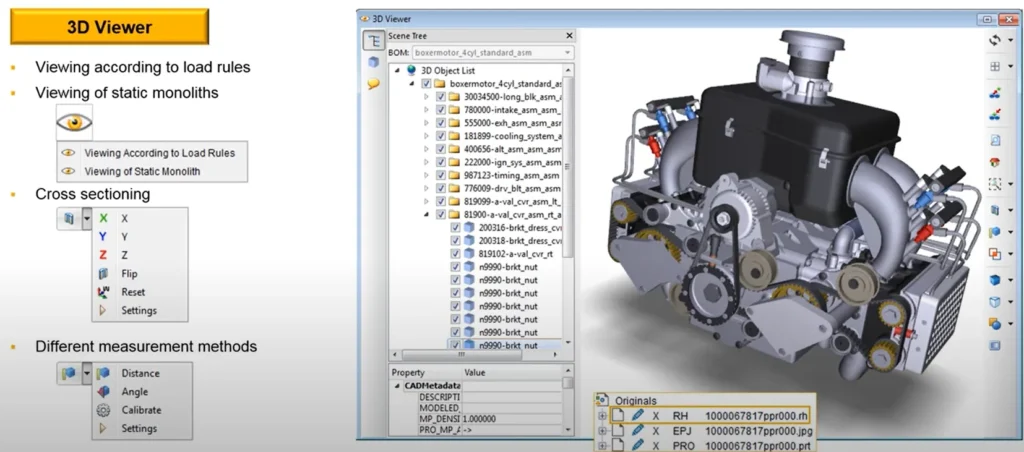

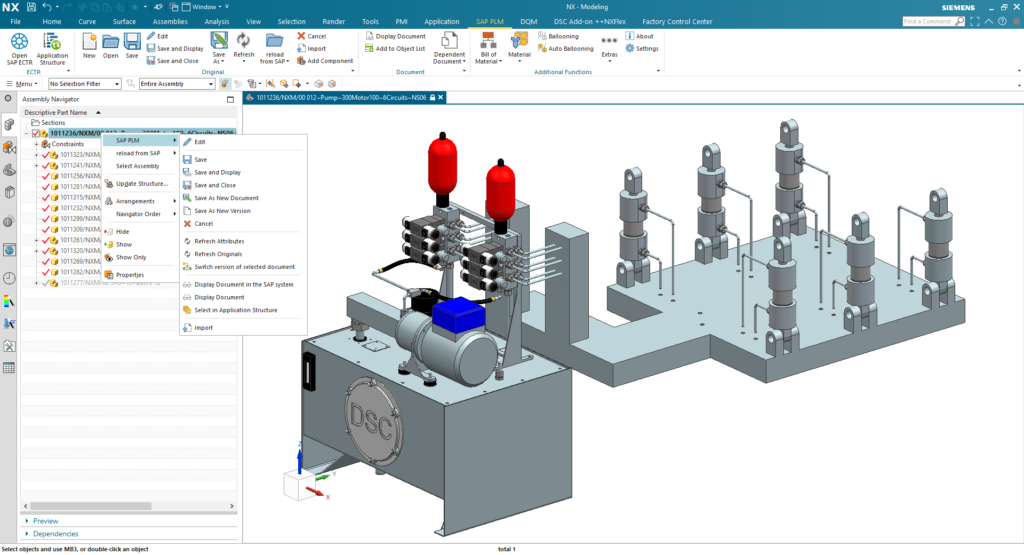

CIMdata writes in its commentary: “SAP’s PLM software provides all the core PLM capabilities product-centric companies require, including idea campaigns (including voice of customers), requirements/specification management, CAD integration, recipe formulations, collaboration, BOM management, document management, variant management, change management, portfolio and project management, systems engineering, product visualization, and collaboration with procurement and other departments, even beyond the enterprise with suppliers.”

Furthermore, “SAP provides a comprehensive set of integrations to support a company’s ecosystem, including multiple mechanical computer-aided design (MCAD), electronic computer-aided design (ECAD), ERP, and PLM integrations.”

How extensive are these integrations? Partly there is a support for integrations through SAP PLM, partly through SAP’s Engineering Control Center (ECTR). This includes MCAD pieces and design tools such as Siemens NX and Solid Edge, PTC’s Creo, Dassault’s CATIA and SOLIDWORKS, and Autodesk Inventor. On the ECAD side there are supports for Altium, Cadence and Siemens Mentor. PLM/PDM integrations providing bi-directional two-way support are also available between S/4HANA and Siemens Teamcenter, PTC’s Windchill and Dassault’s 3DEXPERIENCE, while the connection between Autodesk Vault is scheduled to be completed by late Q3 2024.

”Midmarket companies can benefit significantly from SAP PLM”

Overall, the analyst claims in his conclusion that, “SAP addresses the needs of mid-market companies by providing SAP PLM, a robust cost-effective, and easy-to-implement solution that leverages the advantages of cloud technology. CIMdata is impressed with SAP’s cloud-native SaaS offering based on microservices, rather than merely hosting on-premises software in the cloud. This approach ensures scalability, flexibility, seamless updates, which are important consideration for mid-market companies that cannot afford to manage on-premises enterprise solutions.”

Based on this and the above, CIMdata claims that, “mid-market companies can benefit significantly from SAP PLM, as it encompasses all core PLM capabilities essential for product-centric businesses from idea and concept through life via re-use until disposal enabling seamless interactions not only within the enterprise but also with the extended supply chain.”

Does SAP PLM have the right approach to manage PLM?

Not least the CIMdata-quot above–”…seamless interactions not only within the company but also with the extended supply chain”–say a lot about SAP’s background and its approach to product realization: Generally, the company’s solutions are based on a sequential, transactional view of events. Of course, there are a number of theoretical capabilities in the system, but the fundamental problem is that SAP is primarily based on its business system, its ERP solution. This is built on the basis of a sequential view of things that have already happened, such as transactions, which can be well suited to concrete handling such as manufacturing or in process industrial operations with precise recipes. But PLM as product development support is, by its very nature, something that describes virtual processes where nothing actually happened in physical reality.

Theoretically, the enumerations that CIMdata makes sound like a good technical basis, but the SAP on prem reality has proven to be quite complex and, above all, expensive to both implement and operate. In the analyst Gartner’s ”Peer Insights”, where companies can respond with views about SAP PLM, there are examples of positive views around SAP PLM, while other things are more critical. Below some examples of both:

What is positive? A user points out three peaks:

1. “The level of details that we can manage is quite comprehensive”

2. ”Data management around BOM, inventory, etc is good”

3. “Integration with SAP ERP is smooth.”

All three points relate to transactions in particular and to a large extent things that relate to physical manufacturing and to the role of the ERP system in production.

What is negative? Same user again:

1. “It is quite slow and becomes frustrating at times”

2. ”The user experience is not very intuitive, high needs to be trained to use it”

3. “Integration with non-SAP applications is quite challenging.”

Weaknesses in performance, in the interface, in the integration and interaction with other systems.

A hollow recommendation

CIMdata’s conclusion is again that it is impressed by, “SAP’s extensive set of integrations that support a company’s existing environment. This includes integrations out-of-the-box with various MCAD and ECAD solutions, as well as S/4HANA or other ERP and enterprise solutions including other PLM-enabled software. These integrations ensure that all relevant data and processes are interconnected, enhancing efficiency and reducing the risk of errors.”

So it can be, but the number of integrations is more of a quantitative than a qualitative measure. You can make integrations in large quantities, but which are plagued with errors or limitations that make them inefficient, slow and with sluggish performance as a result.

In several conversations PLM&ERP News has had with users of SAP PLM, this is also a recurring point: Integrations that do not work smoothly, or downright poorly.

In parallell, there is often a lot of politics involved in system selection, and many believe that ”the person who chooses SAP as an ERP system is not taking any career risks.” The system is the most used in the world and if ”everyone else has it, no one can accuse the one who followed the same track of ”far-reaching experiments”. However, this does not mean that whoever made the choice had the product development side in focus when making the choice. On the contrary, sometimes the opposite applies; the decision maker is good at administrative digital tool needs and general industrial economics, but worse at assessing the deeper engineering and product development aspects.

In order to give such an unreserved good rating as CIMdata does in this context, a discussion about how well the company’s integrations work rather than being impressed by the amount of integrations would have been refreshing. If they had spoken to some users, or received some deeper demos/use cases, the matter would most likely not have appeared in such an impressive light. There are several examples of users pointing at this; Sandvik mentioned above is one; BMW, which among other PLM solutions also uses SAP’s, has over the years been critical of SAP’s PLM development efforts and even more so in terms of the substantial costs the system has brought with it.

Can mid-market players afford SAP PLM?

So, when CIMdata concludes its commentary by recommending, “that any mid-market company considering PLM [should] include SAP in their technical evaluation,” there is thus reason for caution. SAP has its advantages in strong ERP-PLM connections and possibly manufacturing-related transaction solutions, but on the pure PLM side, several of the company’s installations show that there is a lot more to be desired than can be delivered.

Certainly, SaaS in the cloud and microservices could be a remedy for previous shortcomings in practical SAP PLM installations, just as a more up-to-date and cloud-native setup could solve several problems previously experienced in practical on-premise installations. But there is a long way to go to fulfill CIMdata’s statement that, “SAP’s PLM approach ensures scalability, flexibility, seamless updates, which is important to consider for mid-market companies that cannot afford to manage on-premises enterprise solutions.” The question is if they can afford SAP PLM.

”What would it mean for SAP to stop PLM?”

Finally, an in the SAP context most interesting quote from the German professor, Dr. Jörg W. Fischer, who in a LinkedIn post reasoned around why SAP, despite the agreement with Siemens regarding Teamcenter, cultivates its own PLM ambitions. Briefly, his reasoning reads as follows:

”Until recently, ERP (and thus SAP) was the central IT system in companies. This has fundamentally changed, but why? Let’s reduce ERP to its core tasks (core ERP): Transform primary demand carriers into secondary demand carriers, initiate necessary production or purchase orders to generate inventory with which the desired products can be manufactured. The quantity and value flows are documented and summarized as revenues or costs for control.”

“For this to work correctly,” continues Dr. Fischer, “it needs a network of semantically correct master data. Let me expand the term ”master data” to include all information and information structures required in ERP (eg BOMars, work schedules, routings, document structures). If I now include all the information structures needed to generate these – requirement structures, function and system structures, CAx structures and more – and expand the definition of ”master data”, reasonable questions are: Why should this master data network be created in ERP? Why shouldn’t we separate the creation and lifecycle from the use of the master data network?”

“The dilemma for SAP: Concentrating on ERP means leaving the creation and lifecycle management of master data to others. Product related business objects and therefore PLM is just the beginning.”

“Next question: Where are a company’s intellectual property rights? Obviously in the master data network and also in the ability to create and ’life cycle’ the master data network. The IT systems that support this represent the heart of the company,

all other systems are only accessories. Previously, this was ERP, because we did not separate the creation, lifecycle and use of the master data network.”

To conclude the reasoning, Dr. Fischer comes to the question in the middle heading above: “What happens if SAP stops PLM … and then maybe hands it over to Siemens Digital Industries Software in the partnership? Let’s project this argument into the future: This risks a massive loss of the importance of ERP coverage in companies. ERP will then no longer be the central core, but just one of many process systems.”

”I am confident that SAP has already realized this and that we will soon see a clearly defined, coherent and holistic strategy for the creation and lifecycle of the ERP master data network.”