The analyst CIMdata writes in a comment on the deal that it is seen, ”as a continuation of the trend of convergence of domains for mechanical design and electronics system design, especially in the strategic role of simulation and analysis to develop products and solutions in several industries.”

It also notes that smart, connected products are common in many industries, and this Cadence acquisition follows other recent transactions in the S&A space, including Synopsys’ Ansys purchase and Keysight’s acquisition of ESI earlier this year, as reported by PLM&ERP News.

S&A a key technology

The S&A segment is growing faster than the MCAD and data management segments and is seen as a key in the enterprise digital engineering and transformation puzzle. This acquisition underlines the importance of S&A and EDA to respond to the trend of smart, connected products.

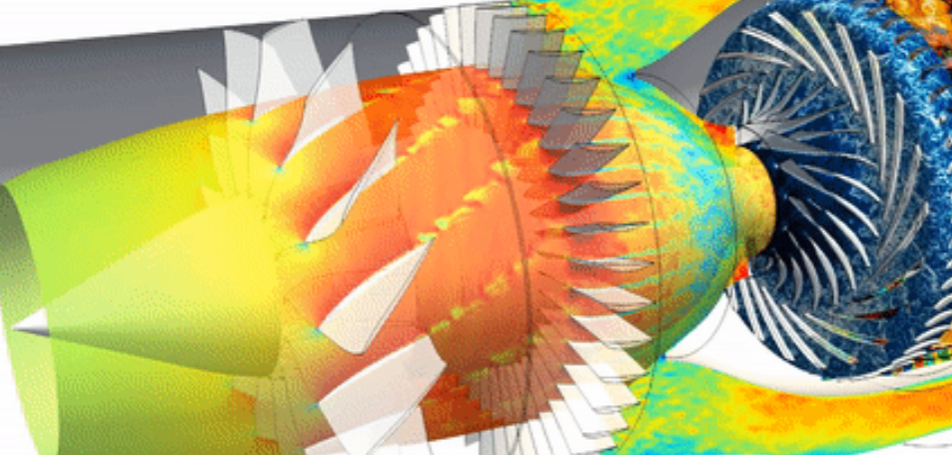

For Cadence, it is of course also no disadvantage that you get a number of larger customers in the bargain, moreover in industries that are the largest in terms of consumption of S&A software and services. Automotive & Transportation are the biggest users/investors of CAE solutions, in 2022 they bet totally $2.5 billion in the domain; followed by Aerospace & Defense at $2.0 billion, and with Electronics/High-Tech in bronze place at just under $1.5 billion.

Moreover, Synopsys purchase of Ansys probably played a role…

BETA ANSA is the flagship product

BETA CAE has grown both steadily and often at double-digit growth rates, at between 8 to 15 percent per year over the past decade. The company has its headquarters in Switzerland since 2018, while the R&D part remains in Greece, where the company was founded.

Among the company’s important acquisitions, the purchase of Japan’s Top CAE Corporation in February 2017 stands out. Another interesting BETA purchase is Indian VARDAR CAE Technologies.

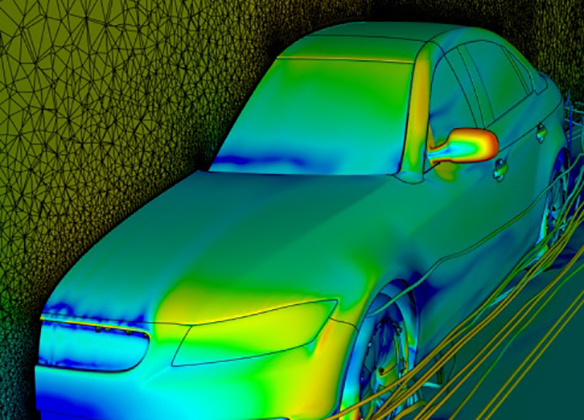

BETA CAE’s flagship product is ANSA, which is widely used in automotive, transport and heavy equipment industry for structural NVH (noise/vibration/harshness) analysis, crash simulation and occupant safety certification. Another core product is META, a high performance multidisciplinary CAE post processor.

BETA CAE’s revenue was $123 million in 2022, up 8 percent from 2021.