This makes automotive of crucial importance to Siemens Digital Industries. They don’t report the exact broken-out numbers for specific industry verticals related to PLM, but a qualified guess is that the automotive segment represents about 30 percent of the company’s revenue out of a total revenue for FY2024 that will end up somewhere in between $6.5 to $7 billion. Hence, success based on capability to live up to what this industry wants is paramount.

Revolutionizing the way vehicles are designed

So, automotive is going through big time changes right now and has been doing so for at least half a decade. Less mechanical content in the cars, more software, SDV platforms, electrification supplied by battery energy, electronics, autonomous driving, digital manufacturing, sustainability and tough regulatory requirements, etc – we’re simply looking at a completely new situation. How has this changed the market demands and needs on the PLM side?

“You’re spot on, the game is changing a lot. But the mechanical design will always remain important and a key part of the design process. However, the winds of change in terms of technology development have altered the proportion sizes of the constituent parts of the whole in relation to each other,” Hemmelgarn replied making the point that the electrical, electronic, and software engineering parts of the automotive product development process are growing significantly at the expence of mechanical engineering.

“It’s not hard to see that software and electronics today really are revolutionizing the way vehicles are designed, manufactured, and operated,” Siemens PLM chief added.

A look at current statistical facts also proves him right. According to a research report published by Spherical Insights & Consulting the global automotive software and electronics market was valued at $274 billion in 2023, and the market size is expected to reach $469 billion by 2033.

Hemmelgarn noted that with the increasing integration of software and electronics in cars, understanding the significance of these trends is essential in the assessment of the industry’s development and where it is heading in the future. But he warns of the not unusual risk of missing the holistic, comprehensive approach when assessing the PLM needs from the new and changed individual aspects.

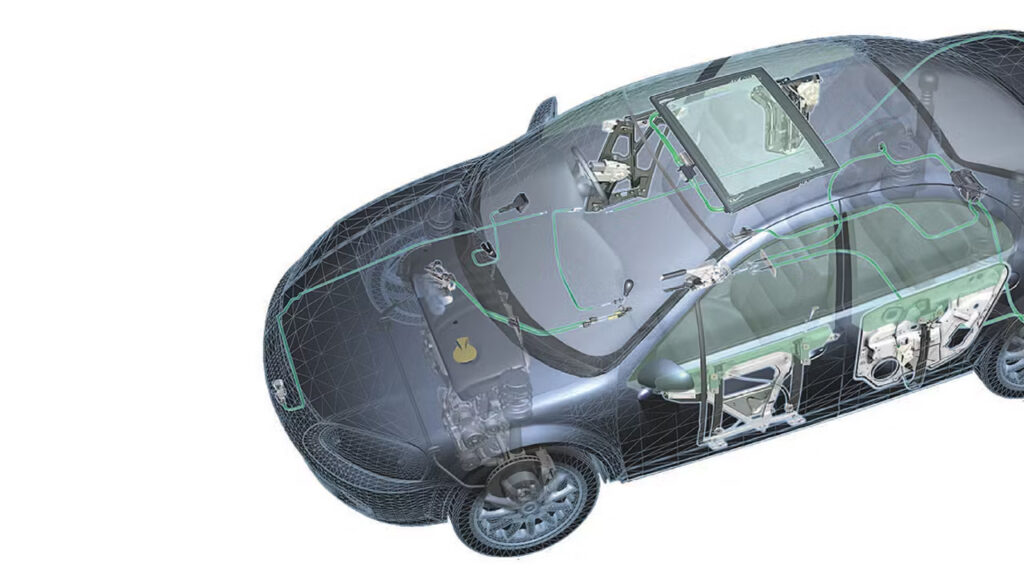

The necessity of a holistic approach

“Yes, I believe that we have to apply a holistic view when we approach these areas. In automotive today you worry about autonomous drive, electrification, battery systems, and much of these types of things are enabled by software and electronics. I made a statement around this at one of our conferences: “Recently a CEO said that he had 1.4 extra kilometers wire harness in his electrical vehicle, adding 70 pounds of weight to the car, costing another 300 dollars in battery expenditures. I said to him that many times we meet people who think of wire harness as ‘wire harness’ instead as an electrical system. It’s easy to fall into siloed thinking when you address these kinds of problems. But it is a holistic system. You’ve got to think about electronics, electrical systems, wire harness, but then also about what it means in for example terms of integrated circuits going into these vehicles. We have now OEM’s starting to determine to build their own integrated circuits. They want to do that to protect their intellectual property. And they want to make sure that they have quality to the level needed for autonomous drive and these types of things as they move forward.”

A full-fledged EDA portfolio

No one needs to doubt Tony Hemmelgarn’s and Siemens Digital Industries Software’s deep insights regarding the needs of electronics-related solutions connected to the PLM side. EDA, Electronic Design Automation, is undoubtedly one of the most central areas of Siemens’s PLM and automation portfolio. Both technologically and commercially it has been a remarkable success. Technologically, because electronics in all parts have become one of the supporting pillars of most of the products of the modern era, and as seen above, automotive included; commercially because around a third of the Siemens PLM related revenues of close to seven billion dollars, comes from EDA.

Seen in this perspective, it only makes business sense that the PLM division’s CEO, Tony Hemmelgarn, invested heavily in acquisitions and organic expansion of this area, with a particular focus on ICs (Integrated Circuits), PCBs (Printed Circuit Boards) and other capabilities related to IT support for product development, design, simulation, validation and manufacturing of everything in the EDA area. The breadth of the company’s offering is impressive in this, while at the same time it is a reflection of what the company’s customers in automotive–of course also aerospace & defense, machine equipment, high-tech, medical equipment and other segments–have on prioritized levels on the investment agenda.

This odyssey of electronic expansion began with Hemmelgarn and his coworkers’ acquisition of Mentor Grapics in 2017 and has continued after that, with the announced purchase of Insight EDA a few months ago as the latest – an acquisition that brought cutting-edge circuit security solutions to many of the world’s leading integrated circuit (IC) design teams.

Today Siemens EDA is one of the PLM-markets broadest integrated electronics (ICs and PCBs) portfolios with this main arsenal:

- Caliber Design IC Physical Design

- Caliber Manufacturing IC Manufacturing

- Tessent IC Test & Lifecycle Solutions

- Questa IC Logic Verification

- Veloce Hardware-Assisted Verification

- Xpedition Electronic Systems & PCB Design

A systematic approach to designing, developing and maintaining software

Software development can at its simplest level be defined as a systematic approach to designing, developing, and maintaining software.

“The field as such is highly multidisciplinary and combines computer science principles, mathematics and engineering work. In automotive, this spans a number of different domains and disciplines that include programming, testing, and project management,” Hemmelgarn explained. “At a basic level, the software that is created must enable, among other things many features and efficient and reliable operational vehicle functions. But it is far from just developing different software in isolation, but also about making them work together.”

As the demand for AI-based systems, infotainment, autonomous driving functions and wireless OTA (Over-the-Air) updates grows at a near-exponential rate, building the ability to manage this increasingly complex software development becomes a tough challenge.

“Then not only in terms of speed in the development work, but perhaps even more important, to create a supporting structure able to manage the integration between all the software systems that are developed and those who develop the systems. Therefore, collaboration and integration into the PLM system is crucial,” asserts Hemmelgarn.

Delayed model programs

Generally, the efforts to carry this integration through is no walk in the park. Software development and product development process integration in automotive is associated with significant difficulties, which is not least shown by the fact that several large vehicle model projects have been delayed, while others have let through bugs that required warranty cancellations that cost the manufacturers a lot of money. Moreover, it is no coincidence that a player like Mercedes Benz realized the extent of the problems and in recent years has invested in building up an infrastructure for software development, which has currently involved hiring more than 3,000 new employees globally at the cost of hundreds of millions of euros.

Software integration and Polarion’s role

So, it’s not without good reasons Tony Hemmelgarn claims that all these things change the game a lot. Software development has caused bottlenecks in many places in the industry, says Siemens’ PLM chief.

“Yes, we see companies today that are struggling to get software out the door in automotive, because software are not where they traditionally been. Now, what do we bring to that? Here is an example of a challenge: You got the requirements process of going into developing whatever product it is, including software. But the software requirements have to be syncronized with hardware requirements. These two worlds are hard to bring together. The software has shorter life cycles, more releases, is updated more often and needs to be synchronized with the longer life cycles of the mechanical parts.”

In this Hemmelgarn points at the critical role played by Siemens ALM system Polarion and its integration to the PLM system Teamcenter. “Polarion provides end-to-end traceability and proof of compliance, and can be deployed in a matter of days and fully configured in a matter of weeks,” he claims, explaining that the solution’s strength is that it, “tracks every software requirement, task, change and test result, while Teamcenter maintains a history of all product data changes. This combined traceability helps for audits, regulatory compliance and understanding the full impact of changes.”

To the commercial backdrop belongs that Polarion has been a fast growing solution. In 2022, for example, this solution had a growth rate that was among the strongest of all the company’s portfolio products.

“In pace with the increasingly importance of the software side and the development of SDVs, the outlook for Polarion looks very good,” notes Hemmelgarn.

”Today, few people object to the description of cars as computers on four wheels. Ever since the introduction of electronic control units (ECUs) in the 1970s, with associated software in the automotive industry, both software and the use of electronics have only pointed upwards. One effect is that the software has become incredibly comprehensive over time. A modern mainstream car today contains around 150 million lines of code and if we expect that autonomous vehicles will be realized, the number of lines of code will be over 300 million to manage level 5, according to calculations made,” says the Siemens Digital Industries Software President.

”A not unexpected notch in the growth curve for electric cars”

In conclusion, Siemens’ PLM leader comments on the declining sales of electric cars. He sees several reasons for this, but believes that over time, ”you can hardly count on a growth curve for technologically new products to continuously point upwards at the same high rate.”

”New technologies are breaking new ground, often resulting in initially low volumes, while newly established manufacturing methods, high battery costs, decreasing subsidies and a sluggish growth rate in terms of charging stations can, in parallel with a generally declining economy, backfire in the form of declining sales. We’re talking about a complex chain of events here that not always move in pace. But over time, the assessment is that electric cars are so important to the sustainability and environmental health of the planet, that today’s declining numbers probably represent more of an unexpected notch in the upward curve than a long term decline.”

Speaking of electric cars and batteries, did you know that Siemens digital tools are running at nine of the ten largest battery manufacturers in the world? Or that last year’s best-selling electric car was not Tesla, as many believed. It’s the Chinese BYD (By Your Dreams) with just over 1.5 million vehicles sold. Which CAD and PLM/cPDm (collaborative Product Definition management) system do they use? The same as Mercedes Benz, Siemens NX CAD and Teamcenter…