A main point behind Lockheed Martin’s decision to go all-in on Siemens Xcelerator is the high level of integrated solutions that it offers around mechanical, electrical, software and manufacturing design. Dale Tutt explained to me that, “Instead of thinking of different product names here and there, it’s really about the full spectrum of products through engineering and into manufacturing and further on. Beyond just the product names, I want to emphasize that the digital tools we can put on the table represent fully integrated end-to-end processes.” It is primarily in this area that Lockheed Martin can start to derive huge benefits.

A Key Contributor to Siemens Aerospace & Defense Success

In today’s article Verdi Ogewell has discussed around Lockheed Martin’s recent PLM investment in Xcelerator tools with Dale Tutt, VP of Industry Strategy at Siemens Digital Industries Software and spokesperson for Siemens A&D division.

He joined the company three years ago with–for this complex area–all the relevant qualifications. Prior to Siemens, he worked at The Spaceship Company, a daughter to Virgin Galactic, as VP of engineering and program management, leading the development of spaceships for tourism. He led the team on a successful flight to space in December 2018. But there’s more on the CV: Tutt has worked at Textron Aviation/Cessna Aircraft in program and engineering leadership roles around the Scorpion Jet program. Here he led a dynamic cross-functional team to design, build and fly the Scorpion Jet prototype from concept to first flight in 23 months. There are more on the CV, but it all lands in competency for his Siemens responsabilities to define the industry strategy and leading the realization of industry solutions for A&D customers. In this position he has been a key contributor to Siemens A&D industry success.

Look at these examples from the last twelve months:

- US Air Force decides to standardize on Siemens Digital Industries Software’s cPDm solution Teamcenter (collaborative Definition management)

- Northrop Grumman announce that the Xcelerator portfolio will be used to complement company initiatives and harness digital technologies across numerous product lifecycle environments to accelerate the development of new products.

- Tough European Boeing competitor, Airbus, select Siemens Mentor solution Capital E/E systems, Electrical/Electronic, to accelerate the development of commercial aircraft.

- Military aircraft giant Lockheed Martin takes a big bet on Siemens PLM portfolio Xcelerator

The list can be made longer, but lands in that Siemens is gaining the upper hand in terms of 2021 growth and is strengthen its position in the technological and commercial battle in the aerospace and defense industry segment (A&D). Mainly at the expense of Dassault Systemes in this large PLM software segment. Generally, automotive and transportation is number one–with global PLM related investments worth around $8.2 billion 2020–closely followed by mechanical machinery/heavy equipment, and A&D with around $5 billion each.

Who is the Leader in the A&D Segment?

This depends on exactly what we’re looking at. According to appsruntheworld.com in 2020, “the top 10 aerospace & defense software vendors accounted for 53% of the global A&D applications market which grew 0.9% to approach nearly $5.34 billion in license, maintenance and subscription revenues.”

Moreover they state that Dassault Systemes led the pack with an 8.7% market share riding on a 5.5% jump in A&D license, maintenance and subscription revenues. Microsoft was #2, followed by Autodesk, Cadence Design Systems, and Siemens PLM Software (which was the name of the division before they last year changed name to Siemens Digital Industries Software). In terms of percentage Siemens had approximately a 5% market share. This may well have changed during 2021, considering several big Siemens orders of which the above mentioned are examples of. The numbers for the full year 2021 aren’t ready yet.

A general observation is that Dassault still holds the lead in the CAD area with CATIA, while Siemens dominates cPDm and the role of a single source of truth product data backbone.

“But these positions is about to change,” says Dale Tutt, pointing at Siemens growing technological strength and far driven portfolio software integration and recent commercial successes.

A Long Standing PLM Customer

How much Lockheed Martin’s investment is worth in dollars, number of seats, services, or exactly what software it covers Dale Tutt doesn’t want to reveal; which is understandable. My guess is that this multi-year agreement has the character of a framework order with call-offs as the projects develop. With such a dynamic, it becomes difficult from the start to define exactly what is needed. But it is clear in any case that the Lockheed order is extensive and affects most software in the Xcelerator portfolio, including a number of familiar PLM and automation applications, such as Teamcenter (cPDm), NX (CAD), Simcenter (analysis & simulation), Mendix (low-code app solution), MindSphere (IIoT operating system), Opcenter (operational technology/MES) and more.

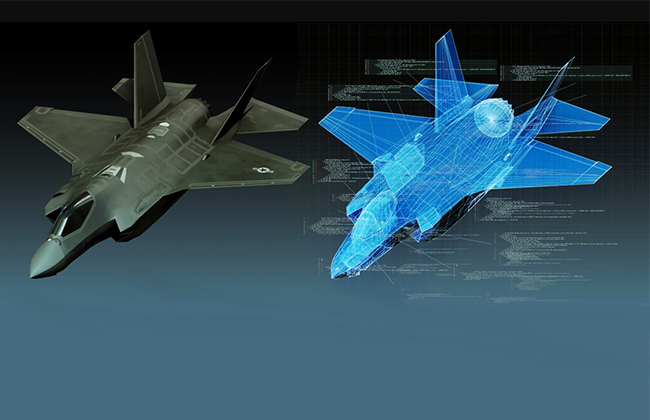

To this story belongs the fact that Lockheed Martin historically has been a long standing customer of Siemens. Just to mention one of the projects where this leading PLM player’s software has been involved the F-35 family of single-seat, single-engine, all-weather stealth multirole combat aircrafts stands out. Here, for example, Siemens’ cPDm (collaborative Product Definition management) solution Metaphase was initially used and later updated to a more modern Teamcenter version. However, on the CAD side, basically, design was made in Dassault’s CATIA; a combination which in no way is unusual.

“True, they used a mix of software in this project. Besides Teamcenter we’re for example talking about some of our simulations, manufacturing, and other solutions that they’ve built up over the years. Of course, mixed with other domain specific solutions. A typical problem of any model program, for example the F-35, is that you tend to end up with a number of often somewhat disconnected solutions,” Dale Tutt commented, adding that, “in this case it’ s a cross-section of engineering and manufacturing solutions, of which CATIA is one, used in the F-35 design.”

An Environment About to Be Changed

Hence, a mixed environment so far, but that is about to change.

”Lockheed Martin Aeronautics’s decision to expand the use of the Siemens Xcelerator portfolio makes it possible to pursue digital initiatives and winning programs,” says Tony Hemmelgarn, Siemens Digital Industries Softwares CEO. “Based on our experience with the F-35 program and through close collaboration, we’re pleased to assist Lockheed Martin in accelerating production and meeting the Department of Defense’s DoD contract requirements for both current programs and new initiatives.”

The Xcelerator portfolio will serve as the PLM foundation in all new and old projects and from a broader view also support the company’s digital engineering transformation. The multi-year contract, implies that Lockheed Marttin will use Xcelerator to achieve its goals for ”mission-driven digital transformation – accelerating program life cycles, driving cost savings and promoting greater innovation.”

This is of course good for Lockheed Martin when it comes to developing next-generation solutions, but it is also good for Siemens, which in addition to leading technology also strengthens what Tutt Dale describes as their “leadership in A&D.”

Which departments in Lockheed Martin is covered by the new deal?

“Generally they are adopting the whole Xcelerator portfolio across the entire company. When they did the evaluation the backdrop was to meet business challenges like to go faster, reduce cycle times, and manage the costs better among other things, and that’s mainly coming down to the air force parts of the company who wanted to gain competitive advantages against everyone else on the market. To reach these objectives they looked at the Xceleratior portfolio, at everything from advanced design, electrical systems design, wing design, wheel systems design, all the way down to manufacturing and to the logistic product and maintenance support once the aircrafts are fielded.”

These angles tell us something of the key advantages that Lockheed Martin wanted to leverage: by establishing an end-to-end capable solution like the Xcelerator portfolio the main objective is to utilize what by far is the longest-running integrations on the market; specifically if you include manufacturing automation.

“Right,” Tutt replies. “They are looking at opting and expanding the Xcelerator platform, not only in the F-35 project but in all new programs to support their full life cycle processes; from engineering to manufacturing to field support as they move forward to maintain world class in Lockheed Martin Aeronautics’ product realization and maintenance support activities. Simply put, this is an all-department activity. We’re looking at areas like program management and supply chain management; how do you effectively collaborate with your suppliers in the big program they have with a lot of partners in all stages in product realization processes.”

Beyond the Product Names

The Xcelerator portfolio cover many areas with a rich tree of solutions and apps – which software are we mainly talking about around last week’s announcement? A not too bold guess is that Teamcenter and NX are main components?

“When we worked with Lockheed we really were talking about the integrated Xcelerator platform, but of course also about the core products on the platform. In terms of Siemens software, that mean areas like design in NX CAD, simulation & analysis in Simcenter, electrical system design in Capital, software development in Polarion, digital manufacturing management in TC Technomatix, e t c.”

Still, a main point is the high level of integrated solutions that Siemens can offer around mechanical, electrical, software, and manufacturing design, Tutt went on, explaining that, “Instead of thinking of different product names here and there it’s really about the full spectrum of products through engineering and into manufacturing and further on. Beyond just the product names, I want to emphasize that the digital tools we can put on the table represent fully integrated end-to-end processes.”

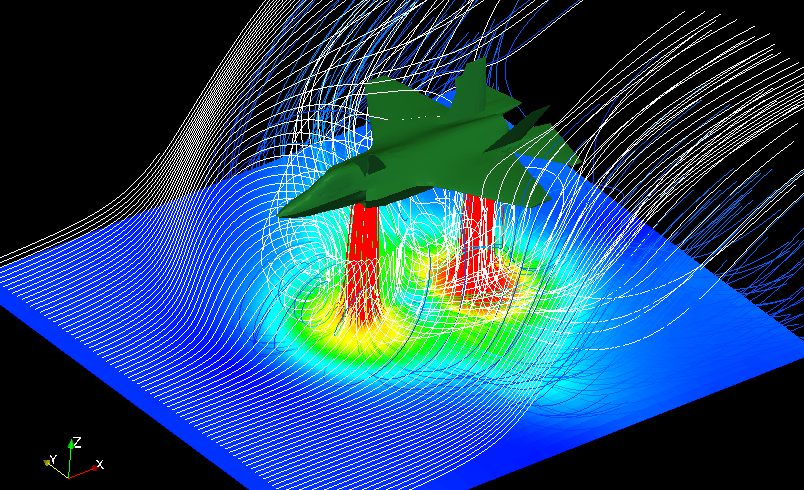

It’s primarily in this Lockheed Martin can start to drive the huge benefits. When we talk about Xcelerator, the angle of attack circulates around things like the comprehensive digital twin, digital threads and flexible eco-systems, and bringing these solutions and partners in product realization together is one of the secrets to provide acceleration in the general digitalization process and superior business value.

Thousands of Seats, but no Exact Numbers Revealed

In a case like Lockheed Martin’s, we’re talking about many software seats and it is always interesting to know more about the details here. But Dale Tutt does not reveal any specific numbers.

“No, we don’t have specific numbers that we can share. Since this contract is extending to existing programs, new programs and legacy programs, it is impossible to determine any exact figures. But generally, we’re talking about thousands of people in the larger organization, so it’s a large number of seats.”

Dale Tutt adds that this deal is much more than just a renewal; we’re looking at a full competitive scenario.

“We have had 150 engineers involved in this evaluation project participating in over several hundred sessions. So, this is really about how they want to adopt the digital transformation process as they are going forward, looking at their business differently and how they want the digital transformation process to radically improve the entire business effectiveness. This is us partnering with them for digital transformation making it possible for them to go faster.”

Cutting Corners With the Cloud and XaaS

Go faster appears to be key words in this deal. But there are other interesting effects. Dale Tutt claims that large deployments like this–the implementation process has by the way already started–has always been painful for big companies. But there is another side to the coin: changes can saw seeds that can make people think about matters from new, outside the box angles.

An example related to that Siemens Xcelerator is now available as a cloud service, called Xcelerator as a Service, or XaaS. At Lockheed Martin, Siemens had the opportunity to change how the company viewed cloud services delivery.

“In one example, we demonstrated how cycle time reduction can be improved by not only delivering a new set of digital capabilities to the engineer, but the speed at which those new capabilities arrive in the hands of those designing, building and maintaining the platform. XaaS plays a critical role in enabling this type of advantage and allows for the scaling of capabilities across the enterprise or within a specified program,” asserts Siemens’ VP of Industry Strategy.

“When we started having this discussion with them, we within the cloud environment were able to demonstrate how quickly we can bring new solutions to them, and how quickly people can gain speed in the new solutions. I think that a lot of companies are stuck in that this is a paradigm hard to get through and really don’t realize that within a cloud environment like XaaS we’re able to deploy solutions quickly, that they are easy to configure, and that we can make the organization operational much faster.

Boeing’s Tough (3D)Experiences

Talking about the scale of the bet that Lockheed Martin now decided to do I can´t help thinking of what happened to Boeings 2017 contract with Dassault Systemes where the latter stated that they were going all-in on DS’ PLM platform 3DEXPERIENCE. Dassault’s CEO, Bernard Charles called it “the ”PLM business of the century” and it was said to be worth $ 1 billion. Within a couple of years, all other solutions would be phased out. But that did not happen. Some project here and there, yes, but far from the sole PLM platform it was intended to be. Turned out that a project of this size can be very hard to push through large OEM organizations like those of Boeing or Lockheed Martin size.

“With Boeing’s experience in mind, you see no risk of the same thing happening in this case,” I asked Dale Tutt.

“I think in the past having been through several of these migrations my personal experience is that, yes, it can be hard. But what we did now was to demonstrate that there are other ways of doing this, ways that really can help you to go through these processes much faster.

In the pressmaterial it is said that all new projects will be started in and and in the further development work will use Xcelerator components as base in Lockheed Martins PLM platform – does this mean that Dassault Systemes software like CATIA and VPM/3DX and PTCs Creo if they have been used will be phased out? What are the most important differentiators between Siemens and DS in terms of A&D?

In the pressmaterial it is said that all new projects will get started in the Xcelerator components as a base in Lockheed Martins PLM platform – does this mean that Dassault Systemes software like CATIA V5 and VPM/ENOVIA and PTCs Creo will be phased out? And what are the most important differentiators between Siemens and DS in terms of A&D?

“I can’t speak for all of the programs in Lockheed Martin. But what I can say is that in the programs going forward they have committed to the Xcelerator portfolio. Obviously on legacy programs we’re probably talking about different business decisions, but the big thing for us and for them is the adoption of Xcelerator as the core for any program going forward.”

Why is Siemens Lockheed Martin Order Important?

My take is that this big A&D players as many others in the industry, still sits in a system architecture with quite a number of elements of non-integrated tools. This has three main effects: many manual import and export activities, and limited traceability if, or when, proprietary interfaces cannot be used.

These pieces, plus a few other things, land in the conclusion that a new architecture on the PLM support could provide a lot; but what are the conditions for a new system?

Simplified described, this means that the platform you build up must be characterized by the possibility of exchanging or jumping between modular units in the systems, without extensive migration activities or adaptations. This is seen as absolutely critical to success.

Here are some parameters:

1. Throughout, it must be possible to establish life cycle management in every domain

2. There must be opportunities for tailor-made support in disciplines such as systems management, mechanics, software and electronics

3. A main point is to have a modular well connected and open platform solution where individual domain environments can be replaced without installation or migration problems

4. Support for standards, capable of covering changes in PLM systems over time.

The Best Integrated PLM and Automation Portfolio in Product Realization

A structure that can meet this should provide support for all engineering and management activities within each discipline. At the same time, these must be fully integrated into a company-wide federal platform. A platform whose individual components can be upgraded independently of the others on the platform.

All processes related to engineering work, such as systems development, software development or mechanical development must be able to be done in dedicated environments, where the processes and flows can take place with traceability, storage and divisibility with relevant accessibility limitations for all in such things as project management, configuration responsibility and related engineering.

Siemens Xcelerator can meet most of these requirements with specific strengths in terms of advanced design capabilities, digital twins and threads, BOM verification and management modules, MBSE (Model-Based Systems Engineering), advanced simulations tools, software management, electrical systems, and by far the best integration between product development and automated, smart manufacturing with for example its solutions for virtual commissioning.

But the main point is the Xcelerator portfolio’s software richness and integration.

No competing platform can beat them on this today.