Of the 55% of companies in AMR Research’s Life Sciences survey that are now evaluating PLM solutions, Siemens believes, ”they recognize the need for a PLM platform to respond to the tough the challenges their innovation process faces today, of which manufacturing and distribution are important keys to success alongside R&D.”

A very reasonable interpretation of the AMR study, but what role can the Dotmatics acquisition play in this? We have looked at the matter in today’s article, but first a few words about Dotmatics.

Who are Dotmatics?

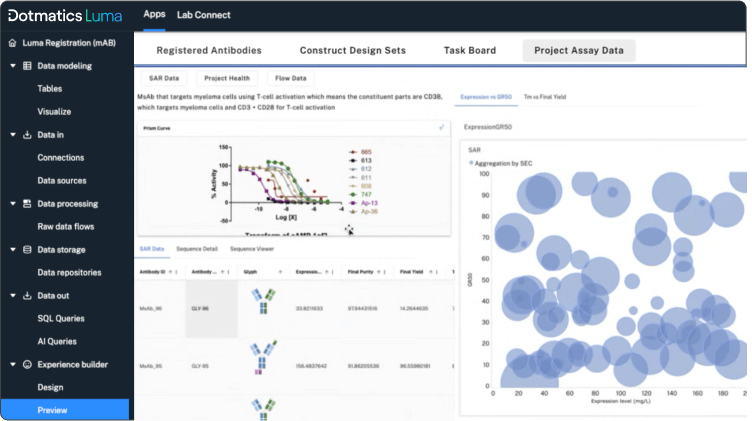

In the press material, Siemens writes that the acquired player, “is a leader in the research and development of scientific software that connects science, data and decision-making.” The business focus rests on the company’s R&D platform Luma and applications such as GraphPad Prism, SnapGene and Geneious, which drive efficiency and accelerate innovation in the pharmaceutical industry.

The company’s VP of Software Engineering for Luma, Scott Stunkel, writes in a blog post:

“In the field of drug discovery, scientific intelligence is as important as data intelligence. For organizations to fully leverage the power of generative AI, all tools must be well-versed in scientific workflows and domain expertise. To get AI use cases into production faster, you need to be able to ingest a massive funnel of scientific data into the cloud, make that data AI-ready, and leverage new AI capabilities offered by advanced data intelligence tools. Today, Dotmatics does this through the Luma Platform, which helps organize data and provide controlled, configured access and data flow across customer ecosystems.”

Dotmatics also has a large and engaged user community, with more than 2 million researchers and over 14,000 customers.

In terms of employees, it is staffed by a global team of more than 800 people dedicated to supporting its customers in over 180 countries.

The company is headquartered in Boston, with 14 offices and R&D teams around the world.

Thomas Swalla, Dotmatics’ CEO, says in a comment that under the current owner, Insight Partners, it has achieved remarkable growth and portfolio expansion and also notes the value of now entering the Siemens environment:

“By combining our next-generation scientific intelligence platform and industry-leading scientific applications together with Siemens Digital Twin and AI capabilities, we will drive a new wave of innovation in life science R&D. Together, we will accelerate innovation cycles for our customers and help researchers make breakthrough discoveries that shape the innovations of the future faster than ever before.”

Decade-Long Development Cycles

Hence, rapid innovation is of great value for a player in the tough pharmaceutical industry. It is also worth noting that few industries have such tough product development journeys towards a successful venture as this one. Developing a drug usually involves processes that extend over 10-15 years. This includes things like research, discovery and patent application, toxicity studies, pharmacology, clinical trials, product registration and approval, and finally industrial scale-up with manufacturing, marketing and sales. All under very strict safety conditions and extensive regulatory requirements. Seen from this perspective, it is perhaps not so surprising that it is difficult to develop efficient models for product development. In parallel it is a well-known fact that pharmaceutical manufacturing is one of the least efficient industries in business.

The Forrester consulting branch of the analyst firm has taken the temperature of the largest players in the industry and conducted a survey where they took a closer look at what the main challenges are. The report, “Transforming Pharmaceutical Manufacturing: Overcoming Hurdles With Digital Innovation”, which PLM&ERP News previously reported on, presents the answers to a series of questions about manufacturing processes, quality assurance and testing. The respondents are 161 technically responsible decision-makers at pharmaceutical manufacturing companies with an annual profit of at least $ 1 billion. The survey was conducted from December 2024 to January 2025.

So what are the key conclusions of the Forrester survey?

Only 17% of respondents currently use a digital twin of their facility, which means that the pharmaceutical industry is lagging behind other industries. However, when it comes to new projects, four out of five companies (79%) use digital twins to improve collaboration and precision in design.

Several interesting PLM connections

Among the key pieces that can be connected to PLM solutions in product development in Life Sciences are things like regulatory compliance. This is crucial for ensuring patient safety and product efficiency. Organizations need integrated solutions here that provide traceability, collaboration and automation to meet changing regulatory requirements in global markets.

Quality management in this area is enormously complex, navigating the ever-changing standards set by organizations such as the FDA and EMA. This requires robust systems to manage CAPA, nonconformities and audits with operational efficiency. The challenge lies in establishing and maintaining high quality standards from design to manufacturing, all in parallel with the global variations that exist. For medical device and pharmaceutical manufacturers, the task is even more daunting than it is for other areas due to the additional burden of dealing with the various facets of compliance with FDA, SEC and international requirements. “The core mandate that guides FDA regulatory oversight is consumer safety. As a result, the FDA has defined current Good Manufacturing Practices for both device and drug manufacturers that dictate the necessary measures that must be taken to ensure that quality systems and processes are in place to consistently produce quality products.”

Notably, regulatory compliance as a domain is more than familiar to Siemens Digital Industries Software, the company’s PLM division. Related products are Teamcenter Quality and Compliance Management, and on the manufacturing side Opcenter Quality and Opcenter Execution.

PLM and the specific needs related to process manufacturing

On the topic of manufacturing, if we look at the connections to PLM related to this and in the case of medical manufacturing, the area belongs under process manufacturing umbrella, in contrast to the discrete manufacturing processes that characterize everything from automotive to mobile phone manufacturing. Process manufacturing is common for the pharmaceutical, chemical and biotechnology industry segments. In process manufacturing, the relevant factors are ingredients, not parts; formulas, not bills of materials; and bulk materials rather than individual units. In process manufacturing, ingredients are usually mixed together to create pharmaceuticals, chemicals, and plastics, to name a few.

Siemens’ strengths in this regard are several related to PLM and automation-linked solutions, especially with the Opcenter Execution Process suite. Goods produced through process manufacturing are manufactured in batches – finite quantities that are usually measured in mass or volume – or via continuous processing. In batch processing, the sequence of process operations for a given product is performed on a batch-by-batch basis. In continuous processing, units of the materials/intermediates are moved from one processing step to the next without interruption, so that each processing step is performed continuously, from one unit to the next. A process manufacturing industry often needs to track processing parameters and test results for each batch, or at set intervals based on volume or mass in continuous flow processing. This requirement can be handled by paper records, but process industries are adopting electronic batch records (eBR) to manufacture more and more to streamline record keeping.

Highly profitable and cash-generating

The overall conclusion is that from whatever perspective one looks at it, the commercial case for making a heavy investment in the Life Sciences area looks promising, both from a financial and technical angle. The acquisition of Dotmatics is also part of the ONE Tech Company growth program, and generally strengthens Siemens’ leading position in industrial software, not least from a revenue perspective:

”Absolutely,” says Ralf P. Thomas, CFO of Siemens AG, pointing to Dotmatics’ strong finances: ”The acquisition of the company, in addition to its technological strengths, also drives strong revenue synergies and is highly profitable and cash-generating. Financing of the purchase will primarily be provided through the sale of shares in listed companies, including Siemens Healthineers.”

In 2025, Siemens expects the company to generate revenues of around $300 million.

Scaling up Siemens technology in Life Sciences

CONCLUSION: Through acquisitions such as this, as well as R&D investments in areas including software, AI-enabled products, connected hardware and sustainability, Siemens clearly prioritizes the allocation of capital to strategic growth areas.

Overall, the conclusion is that the acquisition of Dotmatics enables Siemens to scale up and transfer its technology to Life Sciences and thus fully address growth opportunities in this market. It will enable the German PLM giant to combine its extensive manufacturing expertise, industrial simulation and AI capabilities with Dotmatic’s leading complementary applications, creating a first-of-its-kind, end-to-end digital thread connecting data from research to production in Life Science.

From a general perspective it is also clear that demographics in regions like North America and Western Europe, Japan, and Asia-Pacific skew to older lifetimes, and life science innovators can capitalize on the market opportunities from aging populations, meaning that these markets are rapidly evolving and expanding. PLM analyst firm CIMdata in a contextual comment noted that, ”aging societies have growing medication needs and access to healthcare interventions. New treatment options arise as science advances. Much of this innovation requires increased collaboration and visibility across complex value chains. These trends underscore the need for digital transformation, with life sciences software spending expected to double over the next five years.” Innovative PLM applications during the COVID pandemic highlighted the benefits of digital technologies in life sciences and healthcare applications, particularly with regulatory bodies.

Dassault Systemes, Aras PLM and PTC, all active in this domain, better watch out: Siemens Digital Industries is on the hunt and intends to be a winner in PLM for Life Science.